This IS a challenging time! Like most people, you may find that educating yourself with research, facts, and data is one of the best ways to ease your fears. Looking at past experiences and going over historical trends is one of the many ways we can evaluate any current situation confidently.

Concerns about a global recession are at the forefront of everyone’s mind today, and with good reason. However, it’s important that we take a step back from it all to look at what other kinds of turmoil have occurred over the last few years and how the housing market has behaved during these events.

Today’s Market is Different Than It Was 12 Years Ago

For many, the harsh economic environment of 2008 is still a fresh memory, leading to fear that history is beginning to repeat itself already. Though understandable, these fears are unwarranted.

The current economy is vastly different from that of the recession. Also, the housing market itself is not showing signs that it will be a triggering factor to an economic downturn as it was in 2008. Simply by looking at the way individuals and banks approach mortgages now, the current appreciation rate of homes, the lack of readily available homes on the market, and more, it is clear to see that we are not in the same place as we were 12 years ago. The triggering factors that were in play then are just not there today. Individuals can rest easy knowing that housing will not be the catalyst to economic failure in the foreseeable future.

However, if there does happen to be a recession, Danielle Hale, Chief Economist at Realtor.com, says we can expect it to be very different than the Great Recession, stating:

“Things unraveled pretty quickly, and then the recovery was pretty slow. I would expect this to be milder. There’s no dysfunction in the banking system, we don’t have many households who are over-leveraged with their mortgage payments and are potentially in trouble.”

According to these economic experts, the current market is not indicative of a financial collapse, but instead, it is simply a momentary event.

Whereas the economic crash of 2008 left the country in a state of unknown and did not return to a semblance of normal for nearly 4 years, the current market shows promising signs that if there is a drop, it will rebound quickly. Short-term financial challenges aside, a potential recession due to the global pandemic is not a repeat of the complete market crash that affected everyone in the country not so long ago.

A Housing Crisis And a Recession Are Not The Same

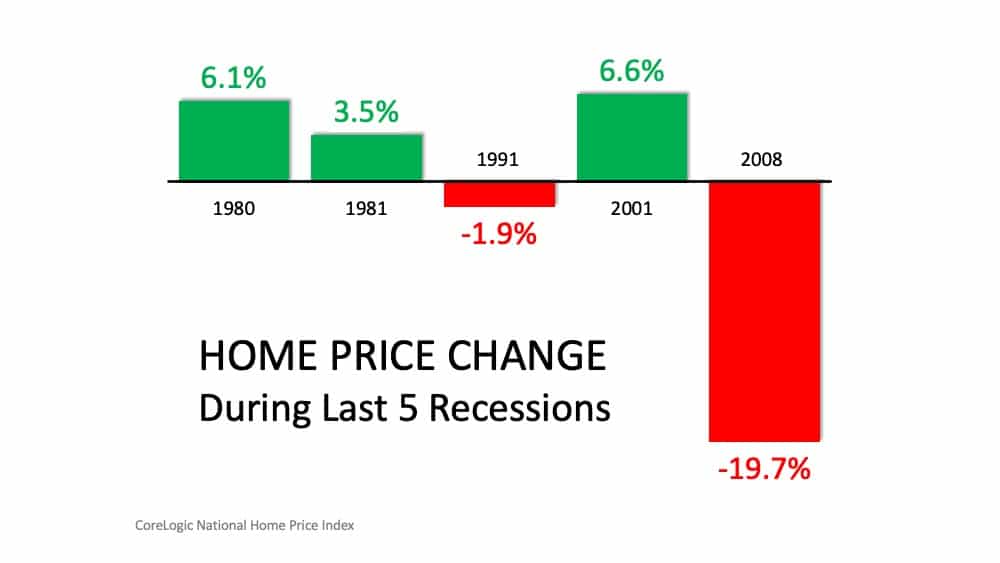

Now, let’s take a moment to look at the previous five recessions in the history of the United States. In three of these recessions, the value of homes actually increased. While the value did decrease by nearly 20% during the 2008 recession, as we mentioned previously there were very different circumstances at play during that time.

In the four recessions that occurred before, the value of homes depreciated only one time. Not only that, but this decrease was less than 2%. In the remaining three economic recessions, the value of residential real estate increased by 3.5%, 6.1%, and 6.6% as shown in the graphic below.

We Can Have Confidence In The Data

The potential effects of COVID-19 on the global economy are very real and therefore concerning. At times they can even be frightening. This pandemic is putting the health and wellbeing of our loved ones at risk, causing us all to feel emotionally taxed. Combining that emotional toil with the fear of another severe economic downturn can leave us all feeling overwhelmed and anxious.

Though no one knows for sure what the exact impact of COVID-19 will be in both long and short-term relation to the housing market, we can be confident that housing will not be a driving factor in the next big economic downturn.

The reasoning behind moving houses, whether it is for family, career changes, retirement, or anything else, will always be an unwavering fact of life. The New York Times recently stated it perfectly when they said “Everyone needs someplace to live.” Yes, concerns about a recession are there and, at times, warranted. However, fears of a housing crisis mimicking that of the Great Recession are misplaced.

Have Questions About the Market? Get in Touch with a Real Estate Expert

Uncertain times often mean uncertainty in real estate as well. When looking into unique properties for sale, that uncertainty can be especially daunting. If you have any questions regarding buying your luxury home in Georgia, contact Anita Wheeler & Co. by phone at 404.219.1938 or by email at AtlantaTopRealtor@gmail.com

425 E. Crossville Road, Suite 213 Roswell, Georgia 30075 Cell:404.219.1938 E-mail: atlantaTopRealtor(at)gmail(dotted)com Website: AnitaWheelerRealtor.com

Please SUBSCRIBE BELOW to our NEW YouTube Channel with tips and the latest marketing reports!